vector Liquidity Bridge

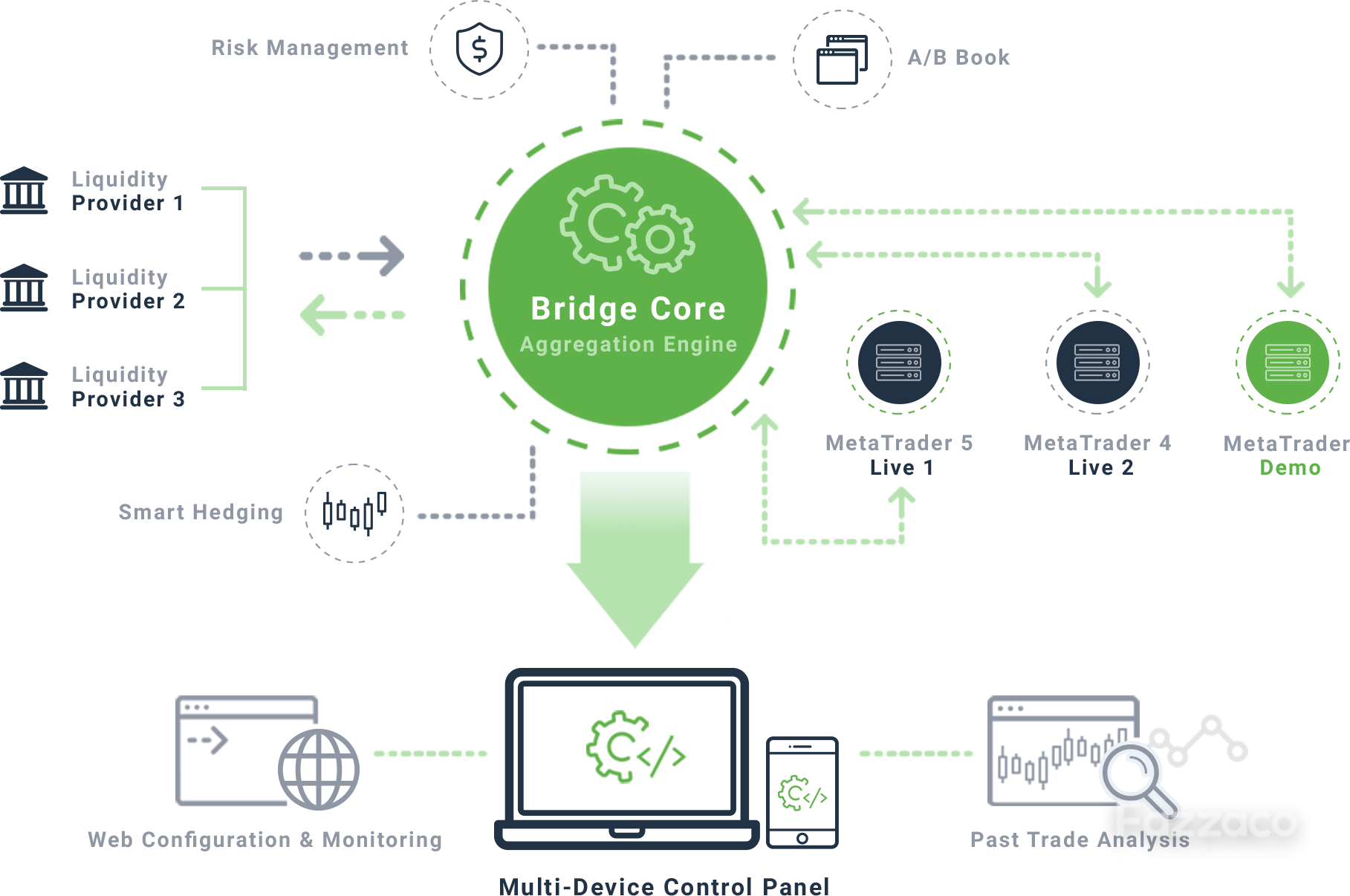

- liquidity bridges are software solutions designed to connect trading platforms (specifically 4 and 5) to external liquidity providers or liquidity pools. These bridges enable brokers to access liquidity from various sources such as banks, financial institutions, and other liquidity providers, allowing them to offer competitive pricing and execution to their clients.

- The liquidity bridge essentially acts as a connection or interface between the broker's server and the liquidity provider's systems. It facilitates the transmission of trade orders, price quotes, and other trading-related information between the two platforms in real-time. This integration helps brokers to aggregate liquidity from multiple sources, manage risk more effectively, and offer improved trading conditions to their clients.

Enhanced Trading with Liquidity Bridges

By using a liquidity bridge, brokers can enhance the trading experience for their customers by providing access to deeper liquidity pools, tighter spreads, faster execution, and potentially lower trading costs. Additionally, it allows brokers to offer a wider range of financial instruments for trading, including Forex, CFDs, commodities, and more.